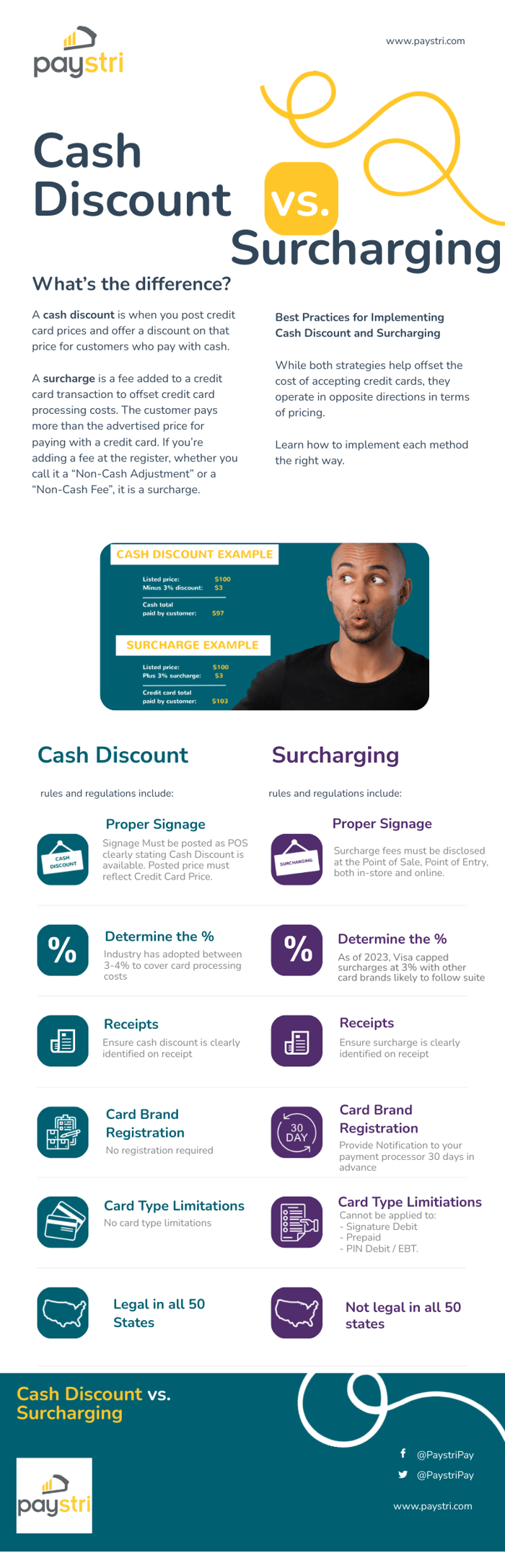

Are you confused about the differences between cash discount and surcharging? Below is an overview and infographic to help you understand the differences.

What’s the difference?

A cash discount is when you post credit card prices at a premium to offset credit card processing costs and offer a discount on that price for customers who pay with cash.

A surcharge is a fee added to a credit card transaction to offset credit card processing costs. The customer pays more than the advertised price for paying with a credit card. If you’re adding a fee at the register, whether you call it a “Non-cash Adjustment” or a “non-cash fee”, it is a surcharge.

Best Practices for Implementing Cash Discount and Surcharging

While both strategies help offset the cost of accepting credit cards, they operate in opposite directions in terms of pricing.

Learn how to implement each method the right way.

If you still have questions about payment processing, offering a cash discount, or setting up a cash discount program or surcharging, talk to the knowledgeable team at Paystri. We can help you get started by providing incentives that your customers will love, which will save you money while keeping your business compliant!