Payment Processing

The Bottom Line: Understanding the Costs of Credit Card Processing

Meredith Weigelt ● November 2, 2023 ● 4 min read

In today's digital age, credit card payments have become the preferred method of transaction for both consumers and businesses. However, for businesses looking to accept credit card payments, understanding the fees associated with credit card processing is crucial. The world of credit card processing can be complex, and it's essential to navigate it with care to ensure your business's financial health. In this blog post, we'll break down the fees associated with credit card processing and provide insights into how to manage them effectively.

The Major Fees to Understand

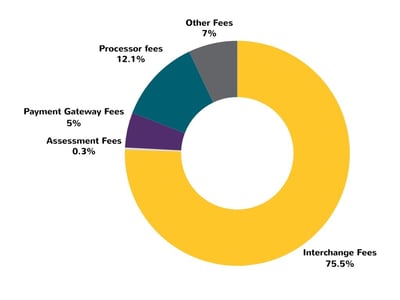

- Interchange Fees: Interchange fees are the most substantial component of credit card processing costs and are set by card networks like Visa, Mastercard, and American Express. These fees go directly to the card issuing bank, such as CapitalOne, Citi, or Chase. These fees are typically expressed as a percentage of the transaction amount plus a flat fee per transaction. The exact amount depends on factors such as the type of card used (e.g., rewards, corporate, or debit), the risk associated with the transaction, and the processing method (in-person, online, or over the phone). While you can't control interchange fees, understanding them is the first step in managing your credit card processing expenses.

- Assessment Fees: Assessment fees are also set by card networks and are typically a percentage of the transaction amount. They help cover the cost of network operations, security, and fraud prevention. This piece of the fee goes to the card brand, such as Visa, Mastercard, Discover, or Amex. These fees are generally consistent across different card processors, so you won't have any room for negotiation here.

- Payment Gateway Fees: A payment gateway is the technology that allows businesses to connect to the card networks. Payment gateway providers charge fees for their services, which may be a monthly subscription fee, a per-transaction fee, or a combination of both. These fees can vary significantly among providers, so it's essential to choose a payment gateway that aligns with your software requirements.

- Processor Fees: In addition to the other fees charged by card networks and gateways, your payment processor will also charge their own set of fees for handling your transactions. This is where your processor generates their revenue. Processor fees may include charges like statement fees, monthly minimums, customer support fees, and other expenses. These fees vary among processors and are an important point of comparison when choosing your provider, as less expensive processing can significantly cut costs over time. It's important to understand exactly what fees make up your total processing costs so that you can accurately evaluate providers and optimize these expenses. Your processor partner should clearly explain their fee structure so you know what margin they are working within.

Additional Costs to Factor In

- Monthly Fees: Many credit card processors charge monthly fees for their services. These fees can include statement fees, account maintenance fees, and other miscellaneous charges. While they may seem small on an individual basis, they can add up over time. Be sure to review your processing agreement to understand all the monthly fees associated with your service.

- Batch Processing Fees: When you settle your daily credit card transactions, your processor may charge a batch processing fee. This fee is usually nominal but should be factored into your overall cost calculation.

- Chargeback Fees: Chargebacks occur when a customer disputes a transaction. If you lose the chargeback case, you may be liable for a chargeback fee, which can range from $25 to $100 or more. To reduce chargeback fees, it's essential to have clear refund and dispute resolution policies in place and to manage customer expectations effectively.

- Non-Qualified and Downgraded Transaction Fees: These fees come into play when you don't meet specific processing criteria set by the card networks. For example, if you manually key in a credit card transaction when it should have been swiped, the transaction may be downgraded, resulting in higher fees. It's crucial to understand the circumstances that can lead to non-qualified and downgraded fees and take steps to minimize them.

- Small Ticket Transaction Fees: For businesses that frequently process small-ticket transactions (typically under $10), some processors offer specialized pricing. Small-ticket fees are designed to accommodate these low-value transactions more cost-effectively.

Strategies for Managing Credit Card Processing Costs

In conclusion, while credit card processing fees can be challenging to navigate, understanding them is vital for the financial health of your business. By familiarizing yourself with these fees, you can make more informed decisions about your payment processing strategy. Additionally, working with a reputable payment processing partner like Paystri can help you navigate the intricacies of credit card processing and ensure that you're getting the best value for your money.

The Benefits of Partnering with a Payment Processor Like Paystri

Why work with Paystri? Paystri is a trusted payment processing provider that understands the unique needs of businesses. With their expertise, you can receive tailored solutions that help you optimize your payment processing, manage fees more effectively, and provide a seamless payment experience for your customers. Paystri's commitment to transparency and customer support means you can count on them to guide you through the world of credit card processing and ensure that your business remains competitive, secure, and profitable. Don't just process payments – process them efficiently and intelligently with Paystri.