Integrated Payments

Payment Processing

Why It’s Time to Evaluate Leaving Your Big-Box Payment Company

● May 3, 2022 ● 5 min read

There’s a reason why they’ve simplified their pricing at 2.9% and $0.30 per transaction—each swipe potentially earns them a substantial amount of money. In order to understand exactly how they’re filling their pockets, you must first understand flat-rate pricing. However, like many things in life, there is more to this than pricing alone, so you must also ask yourself these questions:

- Are they really best fit for your business?

- Are they offering the level of personalized customer service you need or would like?

- Are you getting your funds the next day?

- Are they making strides in offering a wide latitude of payment acceptance hardware and software? For example, advances in related products and services like Cash Discount enable you to pass the cost of the transaction on to the consumer, so take this into consideration.

Not only is it okay to be asking yourself these questions, but it is also critical to the success of your business!

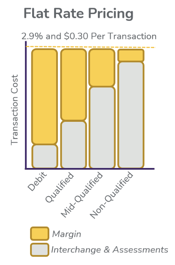

Let’s talk Flat Rate Pricing

Flat Rate Pricing is where your credit card processor is charging you one fixed rate and transaction cost no matter what card types are accepted. 2.9% and $0.30 per transaction has become a common flat rate pricing structure you see often. This was developed to make it simple to understand how much you are paying for accepting credit cards, however it may not be as cheap as you think!

You may be wondering, “Exactly what is Interchange and Assessments?”

Well, it’s what the four cardbrands (Visa, Mastercard, American Express, and Discover) and the issuing banks (think Chase, Citi, and Capital One) charge you every time your customer swipes, dips, or taps a card. Their cut is dependent on the risk factors associated with the transaction and the card types. Think of this as the baseline cost to transact. To put this into perspective, view Visa’s current Interchange rates here. Complex I know - so we’ve simplified things for you in the image above.

Interchange optimization is another consideration entirely, and one in which we’ll follow-up in a subsequent blog. For the time being, let’s focus on the margin your big-box payment company is taking from your pockets (look at all that yellow!).

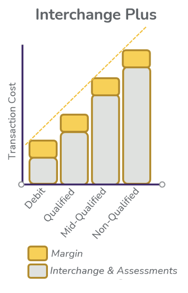

Depending on the types of transactions you authorize and support, as well as the mix of cards your customers use to pay for your goods or services, you may want to consider an alternative to flat rate pricing like Interchange Plus.

What is Interchange Plus?

Interchange Plus is a straightforward way to potentially save thousands every year. These cost savings are due to the wide variability in interchange rates from high fees on rewards cards to lower fees on debit cards.

Businesses miss out on potential cost savings that can come with lower interchange rates. If the types of cards you are accepting are fairly consistent and predictable, a tiered pricing model may help further optimize your credit card acceptance costs.

But how are you supposed to make sense of all of this? Reach out to a qualified payment services company like Paystri and ask for a free statement analysis. Here are other considerations to evaluate beyond cost alone.

Key considerations beyond pricing include:

1. Real Human SupportThere is nothing more frustrating than encountering a problem and not being able to get a hold of a human being to help. This is especially true in retail where a glitch can cost you an in-person sale—a sale that’s much more difficult to recapture than an online one. If you don’t have a provider that supports 24/7 customer support with a live person, you should!

2. Next Day FundingThis is fairly self-explanatory…you deserve to get your funds the following day after you tender a sale.

3. Chargeback and Risk Resolution SupportFrom time to time, customers mistakenly or intentionally dispute a charge. You deserve the opportunity to challenge this dispute and recover any fees associated with a chargeback. Even more impactful, if the risk department holds funds in reserve, you absolutely need the ability to pick up the phone and access a team that will work toward a quick resolution.

4. Seamless and Flexible Integrated FeaturesA one-size fits all approach simply doesn’t work for many businesses. Your business may need:

- An off-the-shelf integration to your accounting software or e-commerce shopping cart

- Invoice management

- Omni-channel payment capabilities (Retail, Over the phone, On-Line, etc) with diverse suite of integrated hardware options

- Recurring billing and hosted payment pages

You need a robust platform with multiple features to support your business’ needs and a team that will work to solve for your business needs.

5. Eliminate Card Processing Fees Entirely

Are you tired of the cost you incur to accept credit cards? There are ways to completely offset this cost by passing along the cost to the consumer. There are a few ways to accomplish this, such as:

- Cash Discount

- Surcharge

- Convenience Fees

There are considerations that you should evaluate as part of determining if eliminating card processing fees is a good fit for your business. This is something that a qualified payment professional will help educate you.

In Conclusion

Consider all of the variables when deciding whether or not you are currently with the right payment processing partner. Where one provider might have felt like the right choice out of the gate, it may be time to reevaluate based on where your business is headed.

Learn how Paystri is helping businesses thrive with straightforward pricing, customized payment solutions and concierge level support. Learn More